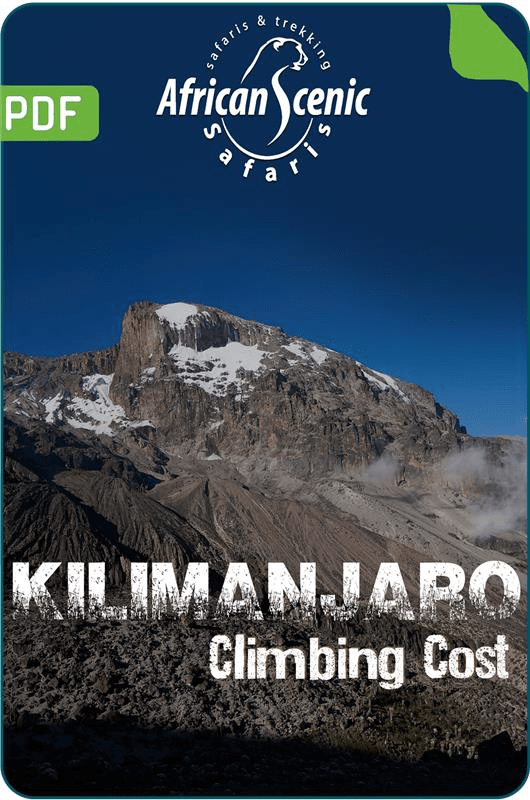

Do You Need Insurance To Climb Kilimanjaro?

Anyone who wants to Climb Kilimanjaro has to acquire Kilimanjaro Travel Insurance which covers high-altitude trekking up to 6,000 meters. It’ll serve as an important resource in case of trip cancellations/ interruptions/ delays, lost baggage, illnesses, evacuation, and any other unforeseen circumstances.

In the following read, you’ll learn about the benefits of Kilimanjaro Travel Insurance with highlights about its types, providers, tips for buying it and claiming process.

Kilimanjaro Travel Insurance

Types Of Kilimanjaro Travel Insurance

Below are the four kinds of Kilimanjaro Insurance along with their coverage options:

Medical Insurance – This covers emergency medical treatment, hospitalization expenses, and medical evacuations.

Evacuation Insurance – This type of Kilimanjaro Travel Insurance covers the unforeseen circumstance of evacuation from the mountain, in case of illness or a serious injury.

Trip Cancellation Insurance – This Kilimanjaro Insurance reimburses climbers for pre-paid expenses in case of trip cancellation. This includes expenses of flights, accommodations, and climbing tour fees.

Personal Property Insurance – Backs you up in case of damage to personal belongings like equipment, gear, and clothing.

Useful Tips

All of the above types cover climbing aspects such as accidents, high altitude sickness, medical evacuation, and financial protection.

Kilimanjaro Travel Insurance

Top Kilimanjaro Insurance Providers

Below are some well-known Kilimanjaro Travel Insurance providers that offer high-altitude climbs. We’ve categorized them based on what coverage they provide and their pros and cons:

| Insurance Providers |

Coverage |

Pros |

Cons |

| World Nomads |

Medical emergencies, trip cancellations and delays, baggage protection, personal accident, adventure sports and activities, and emergency assistance. |

Flexible coverage options cover adventure sports, activities, and 24/7 customer service. |

Can be expensive for long-term travelers, and some activities require additional coverage. |

| Allianz Global Assistance |

Medical emergencies, trip cancellations and delays, baggage protection, personal accident, rental car coverage, and emergency assistance. |

Offers a range of plans to suit different needs, has a mobile app for easy claims, and covers pre-existing conditions. |

The basic plan doesn't cover trip cancellation due to COVID-19; some activities require additional coverage. |

| IMG Global |

Medical emergencies, trip cancellations and delays, baggage protection, personal accident, rental car coverage, and emergency assistance. |

Provides coverage for adventure sports and activities, offers customizable plans, and covers pre-existing conditions. |

Can be expensive for longer trips, and some activities require additional coverage. |

| Travel Guard |

Medical emergencies, trip cancellations and delays, baggage protection, personal accident, rental car coverage, and emergency assistance. |

Provides a range of coverage options, covers pre-existing conditions, and 24/7 customer service. |

Can be expensive for longer trips, and some activities require additional coverage. |

| Seven Corners |

Medical emergencies, trip cancellations and delays, baggage protection, personal accident, rental car coverage, and emergency assistance. |

Offers customizable plans, covers adventure sports and activities, and covers pre-existing conditions. |

Can be expensive for longer trips, and some activities require additional coverage. |

Always carefully review the terms and conditions of your insurance and Kilimanjaro Climbing Packages to ensure they meet your specific needs and expectations.

Some Important Considerations:

- Research the reputation and finances of the insurance company,Ensure they have a good track record of paying claims and providing quality service.

- Read the fine print of the policy to understand the benefits and exclusions of the coverage.

- Understand the claim process and documentation requirements.

- You will need to provide basic information about your trip, such as the dates of travel, the number of travellers, and the type of coverage you require.

Kilimanjaro Insurance Providers for US Travellers – The Kilimanjaro Insurance policies for US travellers vary based on what state they come from. This is because not every state sells the same cover for Kilimanjaro. So, be sure to double-check the contract and read the fine print. Providers – Insubuy and World Nomads The British Mountaineering Council offers Kilimanjaro Travel Insurance UK. But, this is for members only. Other Providers – Insure & Go, Holidaysafe, World Nomads, and True Traveller.

What to Check in Kilimanjaro Travel Insurance

Picking the right daypack is like finding the perfect travel companion for your hiking expeditions. Here are some tips to help you choose the Best Daypack for Kilimanjaro hikes.

High-Altitude Trekking Coverage – Verify that your policy includes medical expenses, rescue services, and emergency evacuation related specifically to high-altitude trekking.

Medical Evacuation Coverage – Confirm that your travel insurance policy covers the cost of medical evacuation, as it can be expensive and potentially lifesaving.

Trip Cancellation/Interruption Coverage – Look for a policy that provides coverage for trip cancellation or interruption to protect your financial investment in case you need to cancel or cut short your trek.

Baggage Loss/Delay – Your policy should cover baggage loss or damage to your baggage as well as reimbursement for necessary items if your baggage is delayed.

Emergency Medical Expenses Coverage – Ensure that the Travel Insurance For Mount Kilimanjaro covers emergency medical expenses, including hospitalization, doctor's fees, medications, and any necessary medical procedures.

Off-Mountain Illness – Any illnesses and accidents that can occur off the mountain should also be included in your Kilimanjaro Travel Insurance coverage.

Theft – You will be carrying valuable items along with you during your climb like expensive camera equipment, sleeping bag, etc. Thus, your Kilimanjaro Insurance also has to cover theft as well.

Quest From The West

January – December 2026

African Scenic Safaris

8 Days Climbing

Travel Style

Scenic Trekking, High-Altitude Adventure & Gradual Acclimatisation

Climb Starts

Moshi, Tanzania

Climb Ends

Moshi, Tanzania

Price On Request

Incl Camps & Accommodations

Orbit Kilimanjaro

January – December 2026

African Scenic Safaris

9 Days Climbing

Travel Style

Scenic Wilderness Trek & Ultimate Acclimatisation

Climb Starts

Moshi, Tanzania

Climb Ends

Moshi, Tanzania

Price On Request

Incl Camps & Accommodations

Without The Whiskey

January – December 2026

African Scenic Safaris

7 Days Climbing

Travel Style

Classic Mountain Trek & High-Altitude Adventure

Climb Starts

Moshi, Tanzania

Climb Ends

Moshi, Tanzania

Price On Request

Incl Camps & Accommodations

Above The African Plains

January – December 2026

African Scenic Safaris

7 Days Climbing

Travel Style

Remote Mountain Trek & Scenic Summit Adventure

Climb Starts

Moshi, Tanzania

Climb Ends

Moshi, Tanzania

Price On Request

Incl Camps & Accommodations

10 Days Lemosho Climbs

January – December 2026

African Scenic Safaris

10 Days Sustainable

Travel Style

Scenic Trekking, High-Altitude Adventure

Climb Starts

Moshi, Tanzania

Climb Ends

Moshi, Tanzania

Price On Request

Incl Camps & Accommodations

Machame Climbs

January – December 2026

African Scenic Safaris

9 Days Sustainable

Travel Style

Classic Mountain Trek & High-Altitude Adventure

Climb Starts

Moshi, Tanzania

Climb Ends

Moshi, Tanzania

Price On Request

Incl Camps & Accommodations

01

/ 06

When Should You Buy The Kilimanjaro Travel Insurance

It’s best to purchase Kilimanjaro Travel Insurance as soon as you book your trip and even before buying your flight tickets. Buying insurance as early as possible ensures coverage for any unforeseen events or emergencies.

An early purchase allows you to benefit from certain features like:

- Trip Cancellation/Interruption Coverage

- Financial Protection in the case of trip cancellation

Moreover, pre-departure coverage offers benefits for trip and baggage delays, assisting you if flights are delayed or if your luggage gets lost.

Hence, buy travel insurance early to have comprehensive coverage throughout your Kilimanjaro Climbing Packages. Although, make sure to review the policy details, limits, and exclusions to have the right policy for your needs.

Tips For Buying Kilimanjaro Travel Insurance

Follow these two golden rules when buying Kilimanjaro Travel Insurance:

- Take into account the level of coverage you need based on your travel plans.

- Compare the costs of different policies to find one that aligns with your budget.

Next up are some Travel Insurance Tips For Kilimanjaro Climbers for getting insurance at great deals:

- Compare policies from different insurance providers

- Be on the lookout for discounts and promotions

- Consider higher deductibles for lower premiums

- Avoid purchasing unnecessary coverage

- Buy your policy well in advance of your trip to secure the best rates and ensure coverage for any unexpected events that may arise before your trip

Adventure beckons, but safety comes first. Your Kilimanjaro Climb deserves protection, and our coverage ensures you can focus on the awe-inspiring views, not the 'what-ifs.' Secure your Kilimanjaro adventure today!

Prevention Is Always Better!

With the right Kilimanjaro Travel Insurance cover, all your worries can take a back seat. It’ll act as a safety net that will protect trekkers from financial loss and ensure they receive the necessary medical attention in case of an emergency.

At African Scenic Safaris, we understand that Climbing Kilimanjaro is a significant investment, and unforeseen circumstances can disrupt plans, leading to financial loss. Therefore, we provide our clients with assistance in selecting the right travel insurance provider that offers comprehensive coverage for their climbs.

Thus, protect yourself with travel insurance and climb with confidence with Kilimanjaro Climbing Packages offered by us.

Explore Kilimanjaro Travel Guide

Find essential topics below to help you plan, prepare, and enjoy your Kilimanjaro travel experience fully.

Climb Kilimanjaro With Us

Get ready for a mountain adventure with real advice, smiling guides, and simple help that actually works. We’re with you from start to summit.

Frequently Asked Questions

The risks involved in a Mount Kilimanjaro Climbing adventure include trekking in a remote region, unpredictable weather, and high altitude-related illnesses.

The main Kilimanjaro Health & Safety concerns include Acute Mountain Sickness (AMS), hypothermia, cold and respiratory infections, etc.

Climbing Mount Kilimanjaro is generally safe, but it carries risks due to altitude and extreme weather conditions. Hiring experienced guides and following safety protocols is essential.

Weather conditions on Kilimanjaro can be unpredictable and vary throughout the climb. Be prepared for cold temperatures, strong winds, and potential rain or snowfall.

Altitude-related risks, such as acute mountain sickness (AMS), are common on Kilimanjaro. It is crucial to acclimatize properly, ascend gradually, and recognize symptoms of AMS to ensure safety.

Safety measures are in place on Mount Kilimanjaro, including ranger stations, emergency oxygen, and first aid kits. Guides are trained in mountain rescue techniques and communication devices are available.

Experienced guides are available for climbing Mount Kilimanjaro and are highly recommended. They provide essential knowledge, support, and help ensure Kilimanjaro Tourist Safety.

Training for Kilimanjaro should include cardiovascular exercises, strength training, and hiking to prepare your body for the physical demands of high-altitude trekking.

Kilimanjaro Rescue & Safety services are available in case of emergencies. Helicopter evacuations and medical support can be arranged, but it's important to have travel insurance that covers such situations.

When packing for a Kilimanjaro climb, include essential Kilimanjaro Safety Equipment like sturdy hiking boots, warm clothing layers, headlamps, sunglasses, sunscreen, and a first aid kit.

While it's possible to climb Kilimanjaro alone, joining a guided group is safer and recommended. Group climbs provide support, experienced leaders, and help in case of emergencies.

The best times to climb Kilimanjaro in terms of safety are during the dry seasons: January to mid-March and June to October. These months typically have better weather conditions and higher chances of a successful climb.

Simbo Natai, founder of African Scenic Safaris, crafts sustainable, meaningful Tanzanian journeys rooted in his deep local knowledge and passion.

Director

Quest From The West

Quest From The West

African Scenic Safaris #1 on TripAdvisor

African Scenic Safaris #1 on TripAdvisor